November 16, 2023

Efficiency in Underwriting is great, but innovation will be your saviour

If insanity is doing the same thing while expecting different outcomes, then a business strategy solely focused on growth through efficiency is quite literally insane. Put otherwise, we cannot reasonably assume that implementing new business models at reduced cost will support material growth, whether in markets still growing or in others where insurance sales may be stagnant or potentially in decline.

Within the Australian marketplace, for example, it is no secret that market decline has resulted in a number of insurers reorganising their workforce to reduce costs, yet few have taken significant steps towards innovative underwriting. Delivering operational efficiency is important, but it is not in and of itself a way out of the storm, or a cunning strategy to excel in thriving markets.

According to Andrew Doran, Global Chief Underwriting & Claims Officer at Pacific Life Re, the last 15 years have seen steady innovation in the field of underwriting automation, and that most traditional underwriting practices are increasingly recognised as barriers to meeting the modern, digital-first expectations of customers when it comes to the insurance purchasing experience.

While data and AI dominate current industry discussions on what is going to support innovation, and for good reason, are we as an industry approaching the problem with the right mindset to ensure successful innovation? According to Gartner, “While many insurers talk about ‘innovation’, few are taking a radical approach to innovation to drive business transformation.”

So how can we challenge ourselves to be more radical? McKinsey observed features of successful innovators, highlighting the need for big companies to evolve by reinventing core business models before technology-driven start-ups do it for them. This message holds particular significance for underwriting operations, where core business models are entrenched in traditional, tried-and-tested approaches built on years of incremental experience. Can we, as underwriters, self-disrupt our traditional model in a way that supports material growth?

McKinsey also observed that “most big companies are reluctant to risk tampering with their core business model until it’s visibly under threat. At that point, they can only hope it’s not too late”. The ability to innovate the core business model in underwriting may hold the key for some insurers to achieve success in the market.

The evolution of underwriting operations

Many, like Deloitte, observed that the role of the underwriter will be impacted by technology, requiring that the underwriter evolve their skillsets to be a conduit between technology and innovation. However in this article, I would challenge insurers to think bigger, and consider what changes could be made to innovate the core underwriting business model. We can achieve this by critically reflecting on the fundamental reasons of why we underwrite in the first place, and by focusing on the real value proposition which our profession brings to the insurance market.

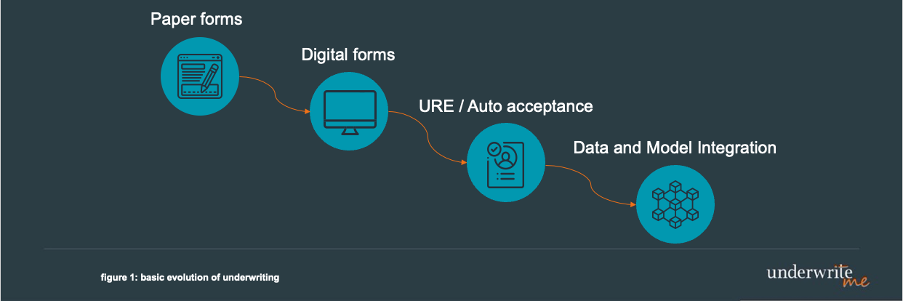

Figure 1

If we reflect on the basic evolution of underwriting (Figure 1) and its stepped innovations, we can observe that at each step of the journey, we have successfully delivered an improved version of what came beforehand. The transition from paper to digital forms created the much-needed efficiency in capturing, storing, and interpreting underwriting data. This shift almost instinctively led to early automation of decisions, linking customers answers to a predetermined list of acceptable outcomes, ultimately saving underwriters’ time when processing straightforward insurance applications.

In the modern era, we are moving ever forward, augmenting our underwriting process by integrating with additional data sources, and deploying AI models to deliver more nuanced underwriting solutions in more complex scenarios. In many cases, insurers still rely on lengthy questionnaires, however simplified issue solutions have helped to address this, albeit in some cases, at the expense of achieving a lower premium or comprehensive coverage.

The need for holistic underwriting innovation

Perhaps the challenge is that insurers have focused too intently on trying to innovate the operational aspects of underwriting, without considering the potential for innovation within the underwriting core business model itself. After all, underwriting is the means to an end – a method of achieving the right balance of product and price, which is the fundamental value proposition for underwriting.

For the customer, the value lies in the protection the insurance product provides – the peace of mind that in the event of death, serious illness or disability, the insurer will deliver on the promise to provide the financial assistance so critical to the insured and their dependents at their time of need. This is the why of insurance, the reason for its being, and the goal of the insurer is to deliver the product which addresses this need while optimising affordability, so that insurers can deliver protection to the largest number of people.

Thus enters the underwriter; the guardian at the gate, standing vigil over the risk pool in their eternal struggle to balance the scales of risk and premium. Over-romanticised? Perhaps. Though I hold the assertion true, that if your underwriting innovation strategy is solely focused on delivering a more cost-effective way of executing your current underwriting business model, then it may fall short of achieving the necessary growth for thriving in the market. Instead, insurers should consider whether there are new and more innovative ways of delivering on the underwriting value proposition, adapting how they underwrite by utilising alternative methods and data.

The good news is that the technology required to support innovation in how we underwrite is here, and the time is now.

As Andrew Doran observed, our ability to utilise data to deliver predictive modelling to reduce the question burden of the insurance buying experience for customers continues to develop rapidly. So too are developments in new medical screening technologies that allow for less invasive and cost-effective collection of medical underwriting data. These developments create a friendlier customer experience, potentially encouraging more individuals to seek insurance and thereby supporting market growth.

At UnderwriteMe, we are supporting insurers to realise the future of underwriting through the latest evolution of our technology, Decision Platform, which incorporates our class leading rules engine, as well as our latest product Decision Studio, which enables insurers to seamlessly integrate external data sources such as insurance pathology results, directly into their new business and underwriting automation process.

It is technology innovations like Decision Studio, which will be pivotal for insurers seeking to integrate different parts of their underwriting processes to deliver an improved and more valued experience for their customers. At the same time, we continue to collaborate closely with insurers looking to innovate their underwriting propositions by harnessing AI and predictive modelling to find new solutions to the challenges faced by their underwriting team.

Whilst it may be challenging for insurers to accept radical change in processes deeply entrenched in tradition, the need for such transformation has never felt more pressing. After all, all evolutions are resplendent with disruption, and the question is never if, but when. Time will judge whether your organisation is the Uber, or the Blockbuster.